We design customer, data, AI, and technology strategies that accelerate digital transformation and achieve key business outcomes. Our strategy and consulting solutions redefine business models, simplify processes, and engage customers.

We provide AI and Data Analytics solutions that harness the full potential of your data through advanced analytics, uncovering valuable insights to drive informed decision-making.

We align our clients’ customer experience (CX) and business goals with their MarTech strategies, crafting optimal MarTech stacks that create powerful ecosystems for businesses at Hansa Cequity.

We design, implement, and deliver omnichannel digital CX by blending strategic consulting, data, and technology solutions to create innovative customer experiences across platforms.

We transform abstract concepts into tangible design solutions, tackling intricate problem statements and transforming them into comprehensive and seamless experiences.

We at Hansa Direct employ AI-driven insights, scalable solutions, and comprehensive support services to elevate customer satisfaction, enhance service quality, and reduce operational costs.

We design customer, data, AI, and technology strategies that accelerate digital transformation and achieve key business outcomes. Our strategy and consulting solutions redefine business models, simplify processes, and engage customers.

We provide AI and Data Analytics solutions that harness the full potential of your data through advanced analytics, uncovering valuable insights to drive informed decision-making.

We align our clients’ customer experience (CX) and business goals with their MarTech strategies, crafting optimal MarTech stacks that create powerful ecosystems for businesses at Hansa Cequity.

We design, implement, and deliver omnichannel digital CX by blending strategic consulting, data, and technology solutions to create innovative customer experiences across platforms.

We transform abstract concepts into tangible design solutions, tackling intricate problem statements and transforming them into comprehensive and seamless experiences.

We at Hansa Direct employ AI-driven insights, scalable solutions, and comprehensive support services to elevate customer satisfaction, enhance service quality, and reduce operational costs.

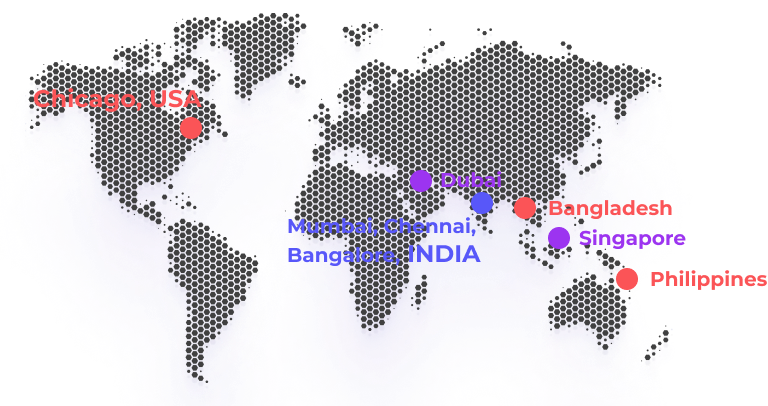

Experience the power of global expertise, available 24/7. Bridging borders with brilliance, our geographically diverse team unites different perspectives to craft solutions for global marketing challenges.

Experience the power of global expertise, available 24/7. Bridging borders with brilliance, our geographically diverse team unites different perspectives to craft solutions for global marketing challenges.