Agentic MarTech For Indian Enterprises: A Comprehensive Executive Playbook

Table of Contents

Agentic MarTech For Indian Enterprises: A Comprehensive Executive Playbook

An Authoritative Guide for CX Leaders Navigating Intelligent Growth Systems in 2026

From Martech Stacks to Thinking Systems: The Rise of the Agentic Enterprise

Neeraj Pratap

CEO, Hansa Cequity

We are standing at the threshold of the most profound transformation in enterprise capability since the rise of digital. The era of agentic enterprises—where autonomous, intelligent agents augment human decision-making and orchestrate entire business workflows—is no longer a speculative horizon. It is here, reshaping how brands sense customer intent, adapt in real time, and scale trust through transparency and governance.

Over the past decade, Indian organizations have made remarkable progress in digital and data maturity. Yet, as generative and agentic AI technologies mature, a new gap has emerged—not in access to data or tools, but in how effectively enterprises can align intelligence, autonomy, and human oversight to deliver compounding business value. This gap will define the next generation of market leaders.

This Agentic Enterprise Playbook has been crafted for CXOs who recognize that the future of martech, experience, and growth is no longer about assembling tools—it is about designing an intelligent operating system for the organization itself. The insights distilled here draw upon real-world implementations, governance models, and cross-sector learnings to guide enterprises from experimentation to scale.

As you read through its frameworks and examples, I encourage you to view AI not as a new department or initiative, but as a new way of thinking—one that connects purpose, data, and action seamlessly. The winners of this decade will not be those with the most advanced tools, but those with the most adaptive systems.

The journey to becoming an agentic enterprise is not optional—it is existential. And it begins with leadership willing to rethink what “intelligence at scale” truly means.

Part 1: Strategy

Agentic Martech For Indian Enterprises – Part 1: Strategy

From Martech Stack To Intelligent Growth System: Why 2026 Is A Breakout Year For Indian Enterprises

The Strategic Imperative

The marketing technology landscape has undergone a fundamental transformation over the past decade. What began as point solutions—email platforms, analytics dashboards, social schedulers—has evolved into a complex ecosystem of specialized tools. Yet the critical insight many enterprise leaders have missed is this: the real value in martech has never been the tools themselves. The value has always been in how tools enable smarter, faster, more personalized customer decisions at scale.

For the past decade, that constraint—the speed and personalization of customer decisions—was primarily a human constraint. CMOs and their teams, armed with dashboards and insights, made the decisions about which customers to target, what offers to present, when to communicate. The best tools were those that made human decision-making faster and better informed.

In 2026, that constraint has shifted. The bottleneck is no longer human decision-making speed—it is the sheer volume of decisions required in a modern customer journey. A single customer might generate hundreds of decision points in a week: when to send the next message, which channel to use, what offer is appropriate, how to adjust the journey based on their behavior. No human team can make those decisions manually at the scale required.

This is where agentic AI fundamentally changes the game.

Why 2026 Is Structurally Different

Three forces converge in 2026 to create an unprecedented opportunity—but also an unprecedented risk—for Indian enterprises.

First: Agentic AI has moved from research lab to operational reality.

For some time, AI in marketing meant either automation (if-this-then-that rules) or assistance (dashboards showing recommendations). Both required human approval or trigger. The fundamental shift in 2026 is that AI agents can now plan, act, and learn autonomously within guardrails, making thousands of real-time decisions daily with accountability and observability.

This is not theoretical. Global implementations demonstrate measurable impact:

- Retail optimization: Walmart’s pricing agents analyze 500 million price points weekly, adjusting 50,000+ items daily based on competitive intelligence and demand, increasing margins by 12% while maintaining competitive positioning.

- Personalization at scale: Starbucks’ mobile marketing platform analyzes 16 million users, delivering personalized offers based on purchase history, weather, location, and time of day, generating $2.56 billion in annual mobile revenue.

- Enterprise automation: Manufacturers using Salesforce Agentforce reduced quote creation time by 60%, eliminated pricing errors entirely, and handled 30% higher sales volume without adding staff.

- Customer service autonomy: Salesforce itself handles 32,000 customer conversations weekly with 83% autonomous resolution and only 1% escalation to human agents—a ratio that would be impossible with human representatives alone.

These are not edge cases or 5-year projections. These are operational realities delivering ROI today.

For Indian enterprises, this opportunity is particularly acute. In BFSI, fintech, and digital-first D2C segments, the competitive intensity is high, customer expectations for personalization are rising, and the scale of customer interactions is enormous. Agentic AI can provide disproportionate advantage precisely in high-volume, high-complexity environments where traditional martech becomes a bottleneck.

Second: India’s AI and data governance landscape is crystallizing.

The IndiaAI Mission, India’s ‘DPDPA 2023’ enforcement, and sectoral regulations (RBI guidelines for banking, IRDA for insurance, SEBI for financial services) are creating a policy framework that favors enterprises that plan for governance from the outset rather than retrofitting it later.

This is a significant shift from the “move fast and break things” ethos that characterized early martech adoption. In 2026, Indian CXOs must assume that:

- Data residency will be non-negotiable. Customer data will need to remain within India for most verticals. Platforms that offer India data centers and local processing will have competitive advantage.

Explicit Consent and audit trails are existential. The DPDPA compliance is no longer a legal requirement—it is a business requirement. Customers who see their data & privacy misused, will leave the brand. Regulators penalties will lead to a diminished brand reputation and trust, thereby increasing the cost to ensure customer loyalty and stickness.

- Model explainability matters. When an AI agent makes a decision (approve a loan, recommend a discount, flag for manual review), organizations need to explain why. Models that operate as black boxes will face increasing regulatory scrutiny.

For enterprise leaders, this means that governance—far from being a constraint—is actually a competitive advantage. Organizations that build governance into their martech architecture from the start will be able to scale agents faster and with better customer trust than those trying to retrofit controls.

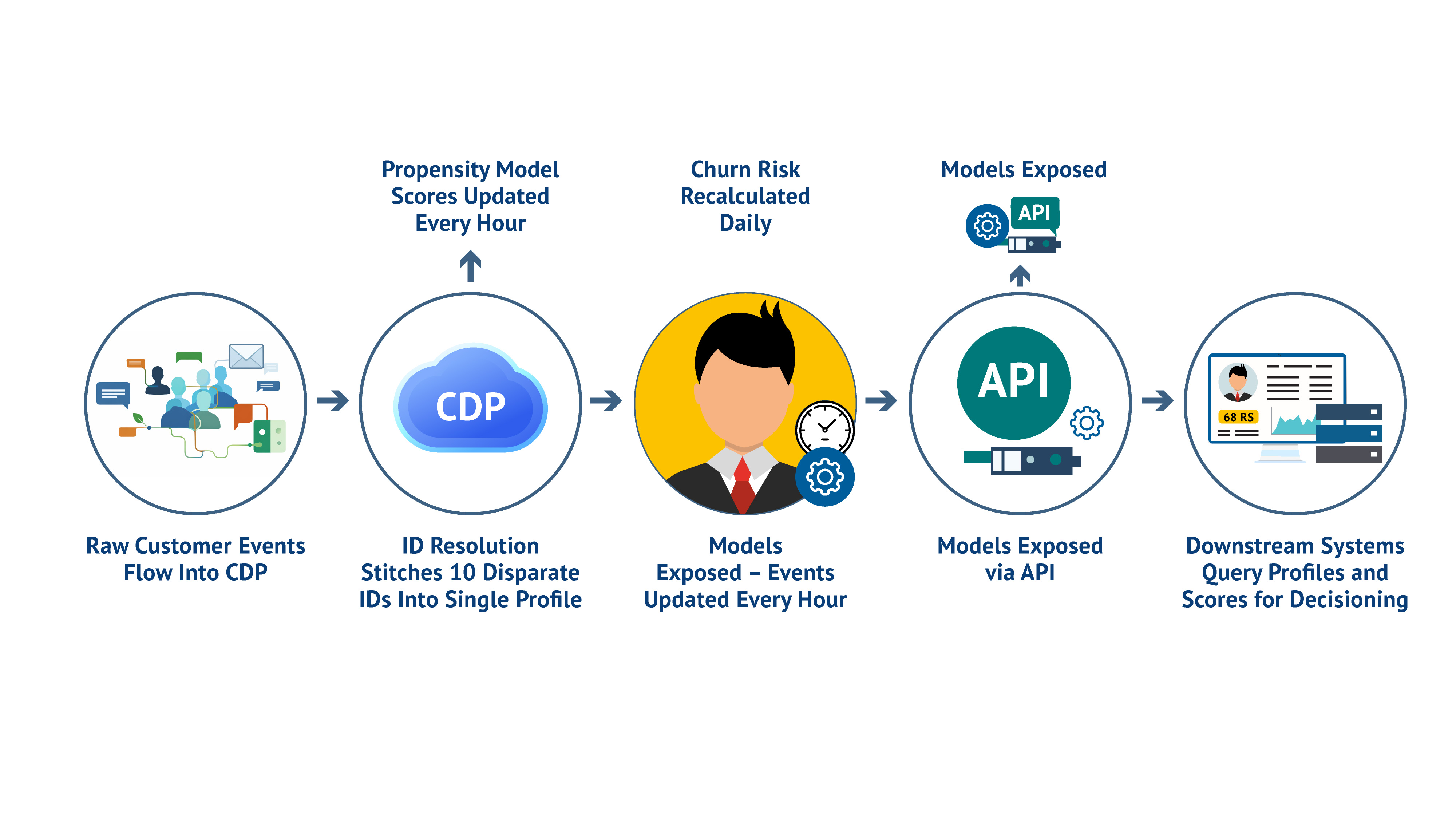

Third: CDPs are evolving from “repositories” to “action engines.”

For years, the CDP narrative focused on unification: “Customer Single View “, “breaking down data silos”, “360-degree customer profiles”. While these still remain relevant, the real value creation in 2026 is happening a layer higher.

Leading organizations use CDPs to store unified customer data as well as:

- Enable real-time decisioning. Adobe RT‑CDP updates customer profiles within 15 minutes of events, meaning agents can access fresh propensity scores, lifecycle stage, and behavioral signals in near real-time.

- Operationalize AI models. CDPs are becoming the hub where propensity models, churn prediction, LTV forecasting, and recommendation engines live as reusable services.

- Federate audiences without moving data. Advanced CDPs allow organizations to activate audiences to external platforms (advertising, email, SMS, call centers) without moving sensitive data outside of secure systems.

Real-world impact: a travel company using Adobe Analytics + RT‑CDP + AEM delivers personalized campaigns to customers immediately after they search for flights—triggering email, push, and SMS offers in real-time, with measurable conversion uplift. Insurance companies identify abandoned applications in real-time & trigger personalized follow-ups.

For Indian enterprises, this shift means that the CDP selection is no longer separate from the martech architecture decision—it is central to it.

The Strategic Framework: Three Dimensions of Intelligent Growth

Based on analysis of 50+ successful enterprise implementations and 100+ organizations still struggling with martech ROI, the critical success factors cluster into three strategic dimensions.

Organizations that excel across all three dimensions achieve 3-4x marketing ROI compared to peers, scale agents safely, and build durable competitive advantage.

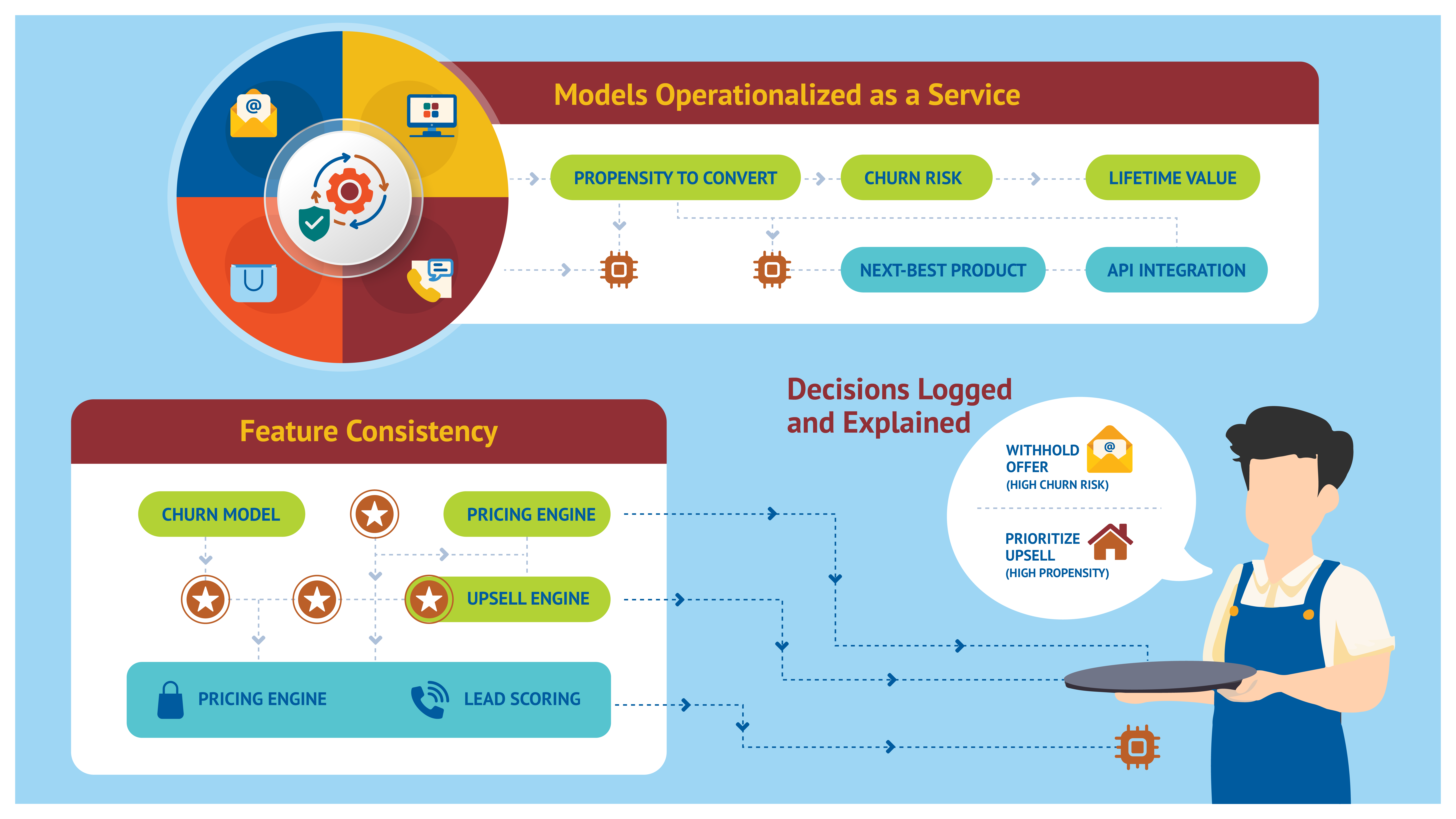

Dimension 1: Customer Data & AI Architecture

Definition: The ability to construct, maintain, and act on a unified, real-time, AI-enriched customer fabric that enables both human decision-makers and autonomous agents to operate with high confidence.

What this means in practice:

The foundation is a unified customer graph—the basic promise of CDPs. But in 2026, the graph must be extended to what we call a “customer and feature fabric”.

In concrete terms, this means:

- Profiles are unified and real-time. When a customer takes an action (views a product, submits a form, makes a purchase, calls support), that event is captured within seconds and available immediately to decisioning systems.

- Models are operationalized as services. Propensity to convert, churn risk, lifetime value, next-best-product predictions—these are not one-off analyses run in notebooks. They are models that update continuously and are available to marketing, sales, and service systems via APIs.

- Features are consistent. A customer’s “high-value” status means the same thing to the churn model, the pricing engine, and the lead scoring system. This requires disciplined data governance.

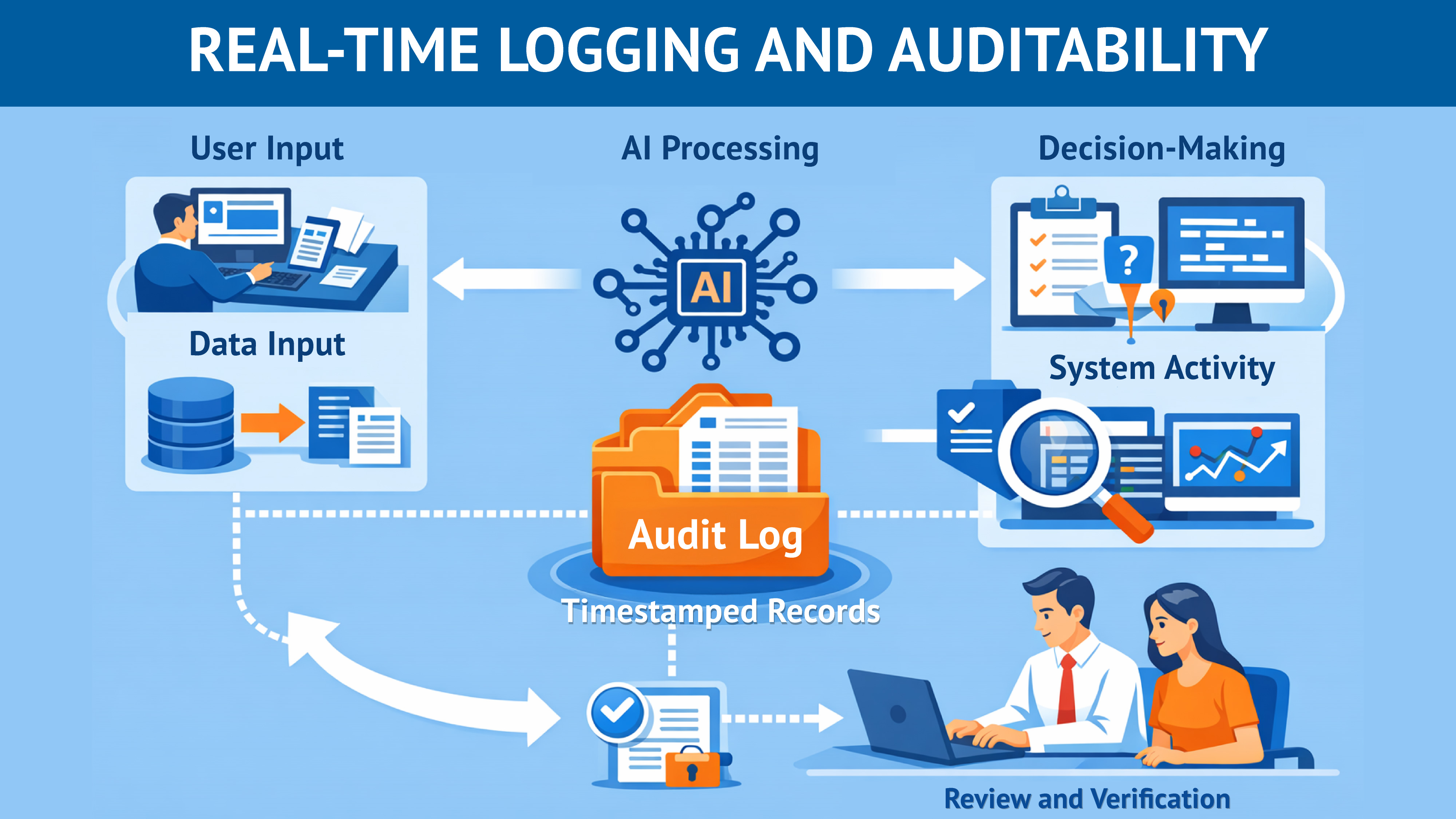

- Decisions are logged and explained. When an agent decides to hold back an offer for a customer because of churn risk, or to prioritize them for an upsell because of high propensity, that reasoning is captured and auditable.

Why this matters:

Organizations without this foundation make decisions on fragmented customer views. A customer is “high value” in one system (BFSI core banking), “low engagement” in another (marketing automation), and “high support cost” in a third (service). When agents try to act, they operate with incomplete information, making suboptimal or contradictory decisions.

Organizations with mature data and AI architecture achieve 3-4x higher marketing ROI. More importantly, their agents make decisions with confidence because they know the data is consistent, complete, and current.

How to assess your organization:

- Do you have a single, authoritative source of truth for each customer, or multiple conflicting sources?

- Can you explain why your churn model, pricing engine, and lead scoring system make different recommendations for the same customer?

- When new data arrives (customer action, behavior change, preference update), how long until it is available to your Martech stack? Minutes? Hours? Days?

- If a data quality issue is discovered (e.g., a field is being populated incorrectly), how quickly can you identify affected decisions and correct them?

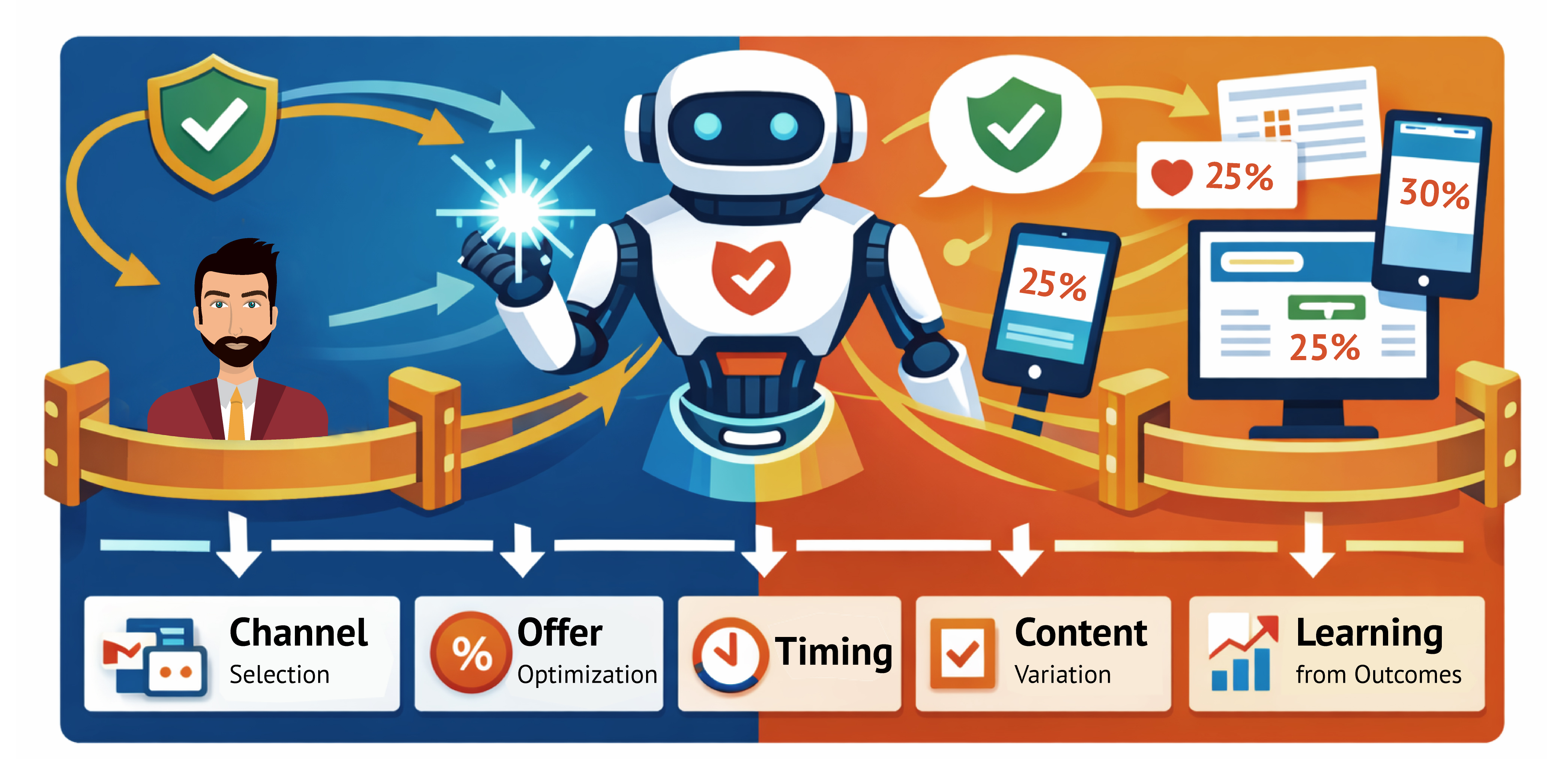

Dimension 2: Agentic Personalization & Decisioning

Definition: The capability to design and deploy autonomous agents that make context-aware, real-time decisions about customer interactions (channel selection, offer optimization, timing, content variation) within explicit guardrails, continuously learning from outcomes.

What this means in practice:

The spectrum of personalization capabilities has expanded significantly:

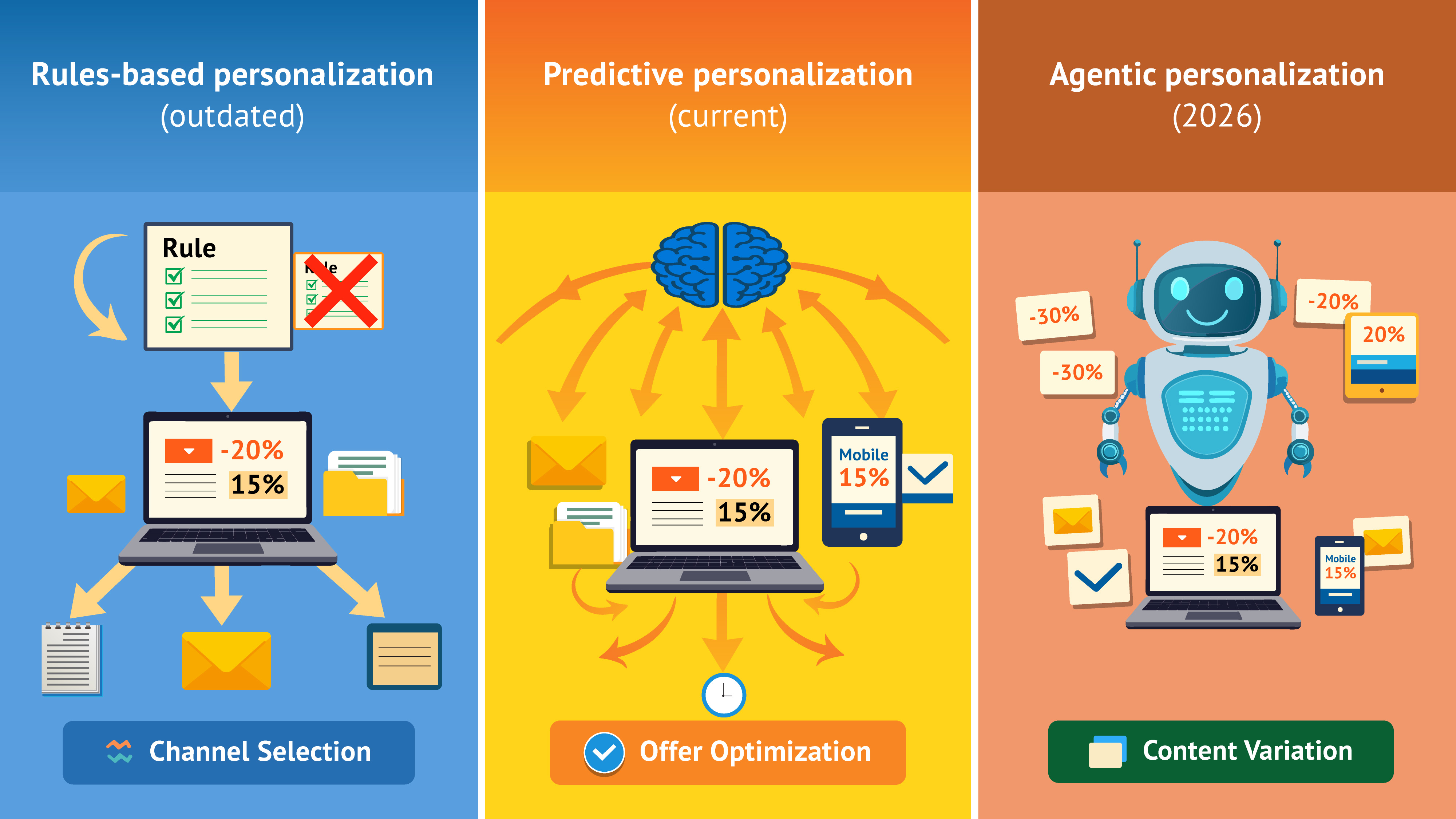

- Rules-based personalization (outdated): If male + age 25-35 + purchased shoes, show shoe accessories. Static, inflexible, low value.

- Predictive personalization (current): If propensity to convert is >60%, send email within optimal send window, with offer tailored to browsing history. More effective but still structured around human-defined rules.

- Agentic personalization (2026): An agent observes that high-propensity customers with cart abandonment respond best to WhatsApp within 30 minutes with personalized discounts, but fatigue occurs after 3 touches in 48 hours. The agent autonomously designs a journey that respects these patterns, learns when they change, and adapts in real-time. All within explicit constraints (discount limits, channel preferences, frequency caps, brand guidelines).

Real-world implementations show dramatic impact:

- Retail optimization: Fashion retailer using AI agents achieved 32% conversion increase through real-time product page personalization and 30% CAC reduction through orchestrated customer journeys.

- SaaS retention: An enterprise platform reduced churn by 18% through AI agents that identified at-risk users and triggered personalized onboarding interventions in real-time.

- E-commerce recovery: D2C brand using agent-controlled send time and channel selection achieved 18% higher cart recovery and 24% lower unsubscribe rate compared to human-managed baseline.

- B2B marketing: Organizations implementing AI-orchestrated journeys achieved 25% conversion rate increase and 30% reduction in customer acquisition costs.

The distinction from “marketing automation” is critical: marketing automation executes predefined flows. Agentic personalization defines objectives and constraints, then lets agents explore millions of micro-variations to find optimal paths.

Why this matters:

The personalization opportunity in customer journeys is enormous—but capturing it manually is impossible. A customer might be receptive to an offer at 2 PM on Tuesday but not Wednesday morning. They prefer WhatsApp 60% of the time but email 40%. They respond to 15% off but not 10%. They tolerate 2 touches per week but churn after 4.

Asking a human team to calculate optimal personalization across millions of customers, dozens of decision points per customer per week, and hundreds of variables is simply not feasible. Agents can do this in real-time.

But agents without constraints become reckless: they discount excessively to drive conversions in the short term, they spam customers with high-frequency messaging, they violate brand guidelines in pursuit of engagement. This is why explicit guardrails—defining what agents can and cannot do—are as important as agent capability itself.

How to assess your organization:

- Are your journeys primarily rules-based (if-this-then-that) or model-driven (propensity-based)?

- Do you experiment with journey optimization, or are journeys set once and static?

- Can you measure the incremental value of personalization vs. baseline campaigns?

- Do you have frameworks for how many touches are acceptable per customer per week? What discount levels are allowed? What channels can be used for which customer segments?

Dimension 3: Operational Autonomy & Marketing Scalability

Definition: The capacity for marketing and customer-facing teams to scale their impact without proportional increases in headcount, achieved by automating routine decision-making and operational tasks, freeing high-value talent for strategy, creativity, and complex relationship management.

What this means in practice:

This dimension has three sub-components:

A) Automation of routine decisions

Marketing automation platforms handle if-this-then-that logic: if customer abandoned cart, send recovery email. If customer hasn’t opened email in 30 days, move to SMS. If customer has made 3+ purchases, move to VIP segment.

This automation is valuable—it eliminates manual task creation and improves consistency. But it is still rules-based and requires humans to define the rules.

In 2026, a new layer sits on top: agents that optimize the rules themselves. An agent observes that cart recovery emails sent at 9 AM have 18% open rate while 6 PM sends have 24% open rate. It automatically updates the send-time rule. Another agent notices that VIP treatment works for customers with LTV > ₹50K but backfires for customers with LTV ₹10-50K (they feel patronized). It creates a new segment.

B) Observability and exceptions management.

Traditional marketing ops require humans to periodically review campaign dashboards, spot problems, and manually fix them. An email campaign with 40% bounce rate requires human intervention to pause and diagnose.

Agentic operations agents monitor continuously. When bounce rate exceeds expected range, they pause the campaign, alert the team, and propose hypotheses (deliverability issue, bad data import, ISP blocking). When a cohort shows unexpectedly high conversion, they flag it as a learning opportunity. When a test variant performs significantly better, they automatically promote it and retire the loser.

This real-time exception management prevents small problems from becoming major incidents.

C) Freeing high-value talent.

When routine decisions are automated and operations are handled by agents, the human team shifts from execution to strategy:

- Instead of manually building 20 campaign variations and analyzing results, marketers can focus on the conceptual breakthroughs: what customer problems are we solving? What offers are worth testing? What narratives resonate?

- Instead of manually monitoring performance and making small tweaks, ops teams can focus on designing the guardrails and decision frameworks within which agents operate safely.

- Instead of triaging 100 support escalations daily, service teams can focus on the 10-15 that require empathy, negotiation, or creative problem-solving.

Real organizational impact is substantial:

- Sales operations: Quote creation time reduced 60%, approvals 40% faster, volume handled 30% higher without additional headcount.

- SDR teams: Lead response times improved 50%, email open rates up 40%, response rates 30% higher, while each SDR gained 2 hours per day of non-admin time.

- Customer service: Service agents handle 83% of routine inquiries autonomously, escalation reduced to 1%, wait times cut by 60%.

- Claims processing: Processing speed up 60%, backlog down 40%, error rates cut dramatically.

The economic model is compelling: organizations either increase customer throughput with the same team, or redeploy team members to higher-value work. Both scenarios improve profitability.

Why this matters:

Talent scarcity is real. Marketing, sales, and service leaders struggle to find people willing to do routine, repetitive work. Agents solve this by handling the repetitive work while freeing talented people for the work only humans can do well—strategy, creativity, relationship-building, ethical judgment.

The cost model changes. In traditional martech, fixed costs (platforms, infrastructure) are low, but variable costs (people) scale with volume. With agentic systems, fixed costs increase slightly (platform licensing, data infrastructure), but variable costs remain flat or decrease as agents handle incremental volume.

The cost model changes. In traditional martech, fixed costs (platforms, infrastructure) are low, but variable costs (people) scale with volume. With agentic systems, fixed costs increase slightly (platform licensing, data infrastructure), but variable costs remain flat or decrease as agents handle incremental volume.

How to assess your organization:

- What percentage of your team’s time is spent on routine, repetitive tasks vs. strategic work?

- When you need to scale customer volume by 25%, what fraction of that requires new headcount?

- How many hours per week does your team spend monitoring dashboards and manually adjusting campaigns?

- How many of your customer interactions could be handled autonomously if you had the guardrails in place?

Translating Strategy To Architecture

The three dimensions outlined above are strategic imperatives, not tactical features. But strategy without architecture is merely aspiration.

The critical insight: All three dimensions depend on foundational architecture choices you make now about how data flows, where agents live, and how guardrails are enforced.

For example:

- If your data architecture is fragmented (different customer IDs across systems, profile updates happening daily instead of real-time), you cannot deploy agents with confidence. Agents will make decisions on stale or incomplete information.

- If you don’t have clear guardrails and governance, agents will optimize for the wrong objectives (volume over profitability, short-term engagement over retention).

- If your martech stack is a collection of disconnected tools, agents cannot orchestrate across channels. A customer sees inconsistent messaging on WhatsApp, email, and SMS.

This is why Part 2 (Architecture) and Part 3 (ROI & Governance) are as important as Part 1 strategy. They translate strategic intent into operational capability.

Global Case Studies: Agentic AI In Action

To ground this discussion in reality, several examples of how leading organizations are executing against these three dimensions:

Retail & Demand Forecasting

Walmart’s dynamic pricing agents process 500 million price points weekly. The agent observes:

- Current price point and competitor prices

- Inventory levels and shelf-life sensitivity

- Seasonal demand patterns and weather forecasts

- Customer purchasing power in each geography

- Promotional calendar and budget

Based on these inputs, the agent autonomously adjusts prices for 50,000+ items daily. The result: 12% margin improvement while maintaining price competitiveness.

This demonstrates all three dimensions:

- Dimension 1: Integrated data about inventory, competition, seasonality, customer demographics

- Dimension 2: Agent continuously learns which price points maximize margin while maintaining shelf velocity

- Dimension 3: Pricing decisions that would require 100+ analysts are now autonomous

Personalization at Scale: Starbucks Mobile Marketing

Starbucks’ mobile marketing platform reaches 16 million users, personalizing offers based on purchase history, location, weather, time of day, and seasonality. An agent analyzes:

- Customer purchase frequency and product preferences

- Whether it is morning (coffee) vs. afternoon (refreshers) vs. evening

- Weather (iced drinks surge on hot days)

- Location (customers near a store are more likely to visit)

- Day-of-week and holiday patterns

The system delivers personalized offers that result in $2.56 billion in annual mobile revenue.

Enterprise Sales Automation: Manufacturing

A manufacturer of industrial equipment deployed Salesforce Agentforce to streamline quoting. The agent:

- Receives a customer inquiry with technical specifications

- Automatically queries the configuration system to identify applicable products

- Pulls pricing, applies customer-specific discounts, and generates configuration-specific quotes

- Eliminates manual steps that previously required 45 minutes per quote

Results:

- Quote creation time reduced 60% (45 min → 18 min)

- Pricing errors eliminated (previously ~5% of quotes had errors; now ~0%)

- Sales volume increased 30% without additional sales staff

- Customers receive quotes within 2 hours vs. 2 days, improving competitive position

Customer Service Autonomy: Salesforce

Salesforce itself operates Agentforce Service Cloud, handling 32,000 customer conversations weekly. The agents:

- Categorize and route inquiries

- Resolve routine questions (password resets, feature explanations, troubleshooting)

- Escalate complex issues to human agents with full context

- Follow up on resolved cases to ensure satisfaction

Performance metrics:

- 83% resolution rate (issues resolved without human escalation)

- 1% escalation to human agents

- 95% reduction in manual workload

- Customers getting answers in seconds vs. waiting in queue

These are not 5-year projections or controlled experiments. These are operational realities delivering business value today, across diverse industries and customer bases.

India-Specific Patterns

While the global case studies above provide strategic context, Indian enterprises operate in a unique market with distinct characteristics. Understanding these characteristics is essential for translating global patterns into India-specific strategy.

BFSI and Fintech:

India’s banking and fintech sectors operate at enormous scale (hundreds of millions of customers) with intense competition, complex regulations, and high customer expectations for personalization and service.

A large Indian private bank recently redesigned its onboarding journey after discovering that 60% of customers who opened accounts in branches never logged into the app, and 40% of digital dropoffs occurred between app download and first login.

They introduced agentic personalization:

- Dimension 1: Unified profile stitching branch signups, app behavior, SMS interactions, WhatsApp/ RCS preferences

- Dimension 2: Agents identified that post-branch, high-intent customers respond to WhatsApp authentication walkthroughs better than app notifications; low-intent customers engage better with email educational content

- Dimension 3: Manual coordination of multi-CPaaS channel onboarding (branch, app, email, SMS, WhatsApp, RCS) scaled from a team effort to autonomous orchestration

Results:

Double-digit uplift in app activation, higher product adoption, better retention.

D2C and fast-moving consumer goods:

Indian D2C brands face intense competition from traditional retail and global e-commerce players. The competitive advantage is personalization, availability, and customer experience.

A Tier-1 beauty brand used to send the same onboarding sequence to all new customers. By integrating app, web, and WhatsApp data and introducing agentic journey orchestration, they discovered:

- High-intent customers (product viewed 3+ times) respond to WhatsApp offers within 2 hours

- Low-intent customers abandon when over-messaged; prefer occasional high-value offers

- Weekend purchasing intent differs from weekday

They deployed agents to autonomously adjust channel mix, timing, and offer for each customer cohort. Results: 25-30% faster conversion for high-intent cohorts, fewer churn incidents for low-intent customers.

Key takeaway: India-specific strategy must account for:

- Communication channel preferences: WhatsApp, RCS and SMS dominate; email is secondary; push notifications face delivery challenges on Indian devices

- Regulatory intensity: DPDP, RBI, IRDA, SEBI requirements vary by vertical

- Scale and volume: Millions of daily customer interactions across BFSI, retail, fintech

- Data residency: Customer data must stay in India

- Language diversity: Support for Hindi, regional languages increasingly expected

- Payment ecosystem: Integration with UPI, Indian payment gateways, bank transfers

The three strategic dimensions translate to India context:

- Dimension 1 (Data & AI): Your CDP must support data residency, handle regional languages, integrate with Indian payment systems

- Dimension 2 (Agentic Personalization): Your agents must optimize for WhatsApp and SMS, respect consent under DPDP, handle regional preferences

- Dimension 3 (Operational Autonomy): Your automation must free Indian talent to focus on relationship-building and market-specific creativity

The Board Conversation: What To Communicate

For CXOs preparing to discuss this strategy with boards, the conversation should be framed around three business outcomes, not technology features:

- Competitive advantage through personalization at scale

Frame: “Our competitors are limited by their team’s capacity. They can personalize for high-value segments, but they lack the resources to optimize for millions of customers individually. By moving personalization decisions to agents, we can compete on experience differentiation with any global competitor—but at a fraction of the team and technology cost.”

Supporting evidence: Starbucks generates $2.56B mobile revenue through personalized offers. Fashion retailers achieve 32% conversion increases through AI-orchestrated experiences. Insurance companies recover abandoned applications worth millions through personalized interventions.

- Scalable growth without proportional team expansion

Frame: “Our marketing team can grow our customer interactions by 25% next year—and our headcount stays flat. Instead of adding staff to handle volume, we redeploy talent to strategy and creativity.”

Supporting evidence: Manufacturers eliminated bottlenecks in quoting and handling 30% more volume. Service operations resolved 83% of cases autonomously. Claims processing handled 60% faster with smaller team.

3. Disciplined governance that is a competitive advantage

Frame: “Regulators increasingly expect organizations to explain AI decisions. Rather than retrofitting governance later, we’re building it in from the start—which means we can scale agents faster and with more customer trust than competitors playing catch-up on compliance.”

Supporting evidence: EY India survey shows half of enterprises have multiple GenAI use cases in production; those with governance frameworks are scaling faster and facing fewer incidents. Insurance company caught discriminatory pricing early because they had logging and auditability.

Part 2: Architecture: Agentic Martech For Indian Enterprises

Designing A 2026 Martech Architecture: Where Do AI Agents Actually Live?

The Architecture Imperative

Strategy without architecture is aspirational thinking. A CXO can articulate why agentic AI matters—but if the martech architecture cannot support agents safely, the strategy remains unrealized.

This section is written for technology leaders (CTOs, CDOs, VP Engineering) responsible for making architecture decisions, as well as CMOs and CXOs who need to understand architecture trade-offs well enough to make informed platform and investment choices.

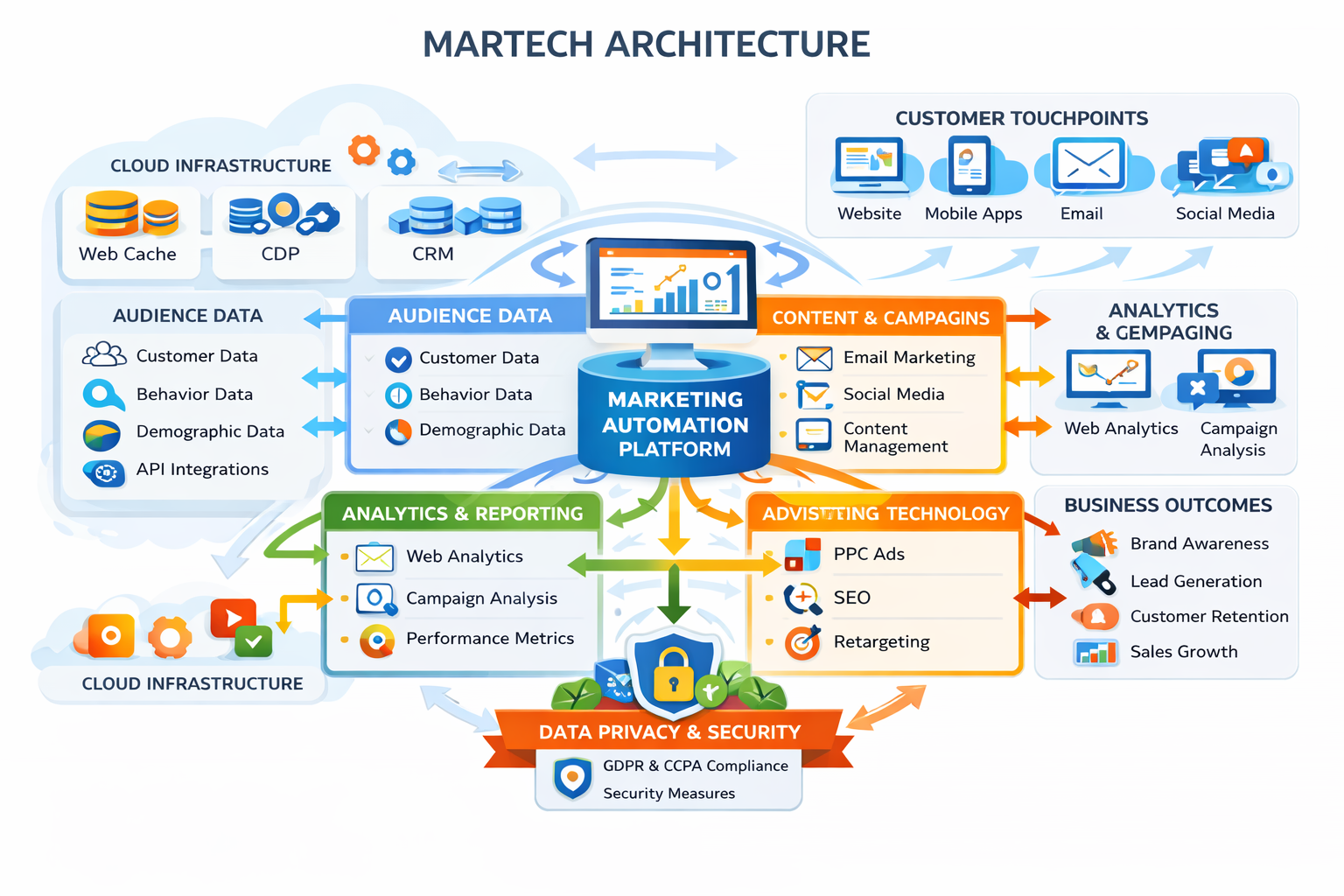

The fundamental insight is this: Your martech architecture in 2026 is not a collection of point solutions. It is a system of systems, with explicitly defined interfaces, data flows, and governance layers. Agents are not a separate overlay—they are a core architectural layer.

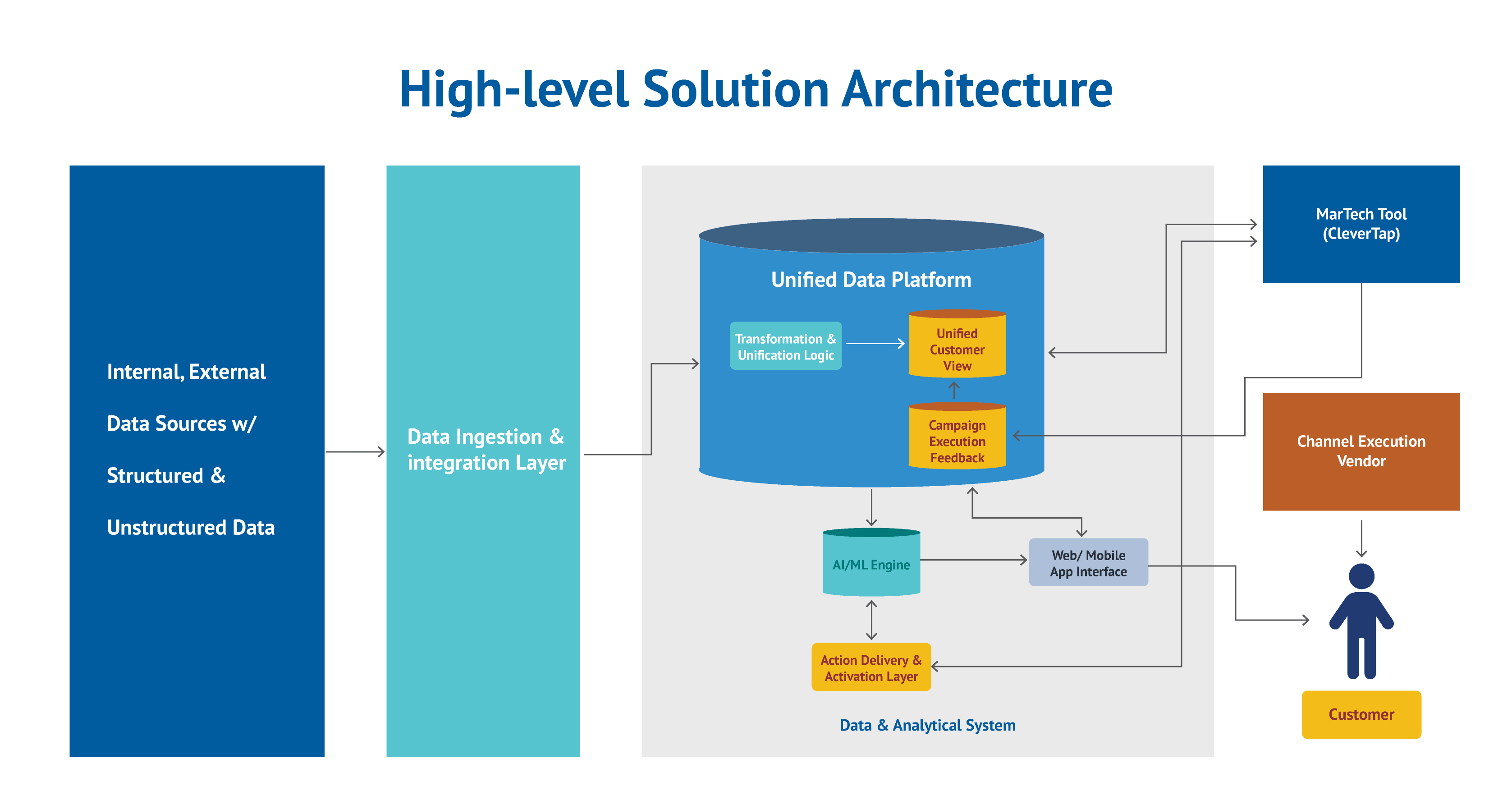

The Three-Layer Architecture Model

Traditional martech stacks are drawn as linear rows: CRM, CDP, email platform, analytics, personalization engine, and so on. This representation obscures how data and decisions actually flow.

A more architecturally accurate model thinks of three interdependent system layers, each with distinct purposes and capabilities:

Layer 1: Systems of Record & Engagement

Purpose: Store core customer and transaction entities; execute day-to-day customer interactions

Primary tools:

- CRM platforms (Salesforce, Zoho, LeadSquared): System of record for customer accounts, opportunities, interactions

- Marketing execution platforms (Salesforce Marketing Cloud, Adobe Journey Optimizer, MoEngage, CleverTap): Systems where journeys are designed, messages are generated, and interactions are orchestrated

- Messaging infrastructure (Netcore, Twilio, AWS Pinpoint): High-reliability channels for email, SMS, WhatsApp, push notifications

- Transactional systems (order management, payment, fulfillment): Where business transactions happen

Critical architectural principle: These systems must have:

- Clean data models with consistent identifiers (customer ID, account ID, etc.)

- Event emission capabilities so every transaction and interaction generates events flowing upstream

- API interfaces allowing upstream systems to read state and downstream systems to trigger actions

- Audit trails and compliance controls for regulated interactions

Example data flow:

Customer opens email → email platform fires “email_opened” event → event flows to CDP → CDP updates profile with latest engagement timestamp → propensity model recalculates → journey orchestration adjusts next-best-action → SMS is sent within 2 hours

This entire flow might happen within minutes, enabling truly real-time personalization.

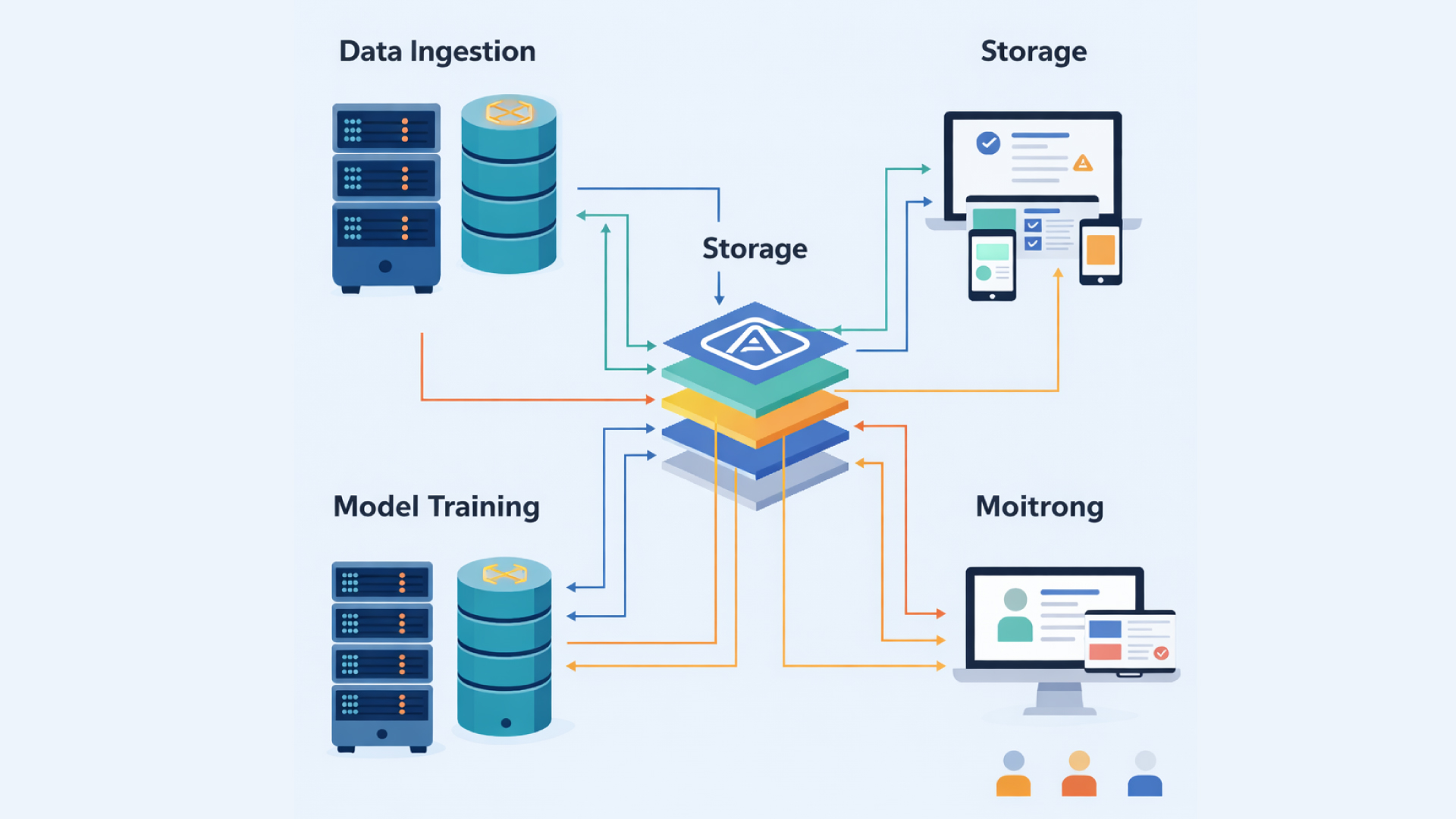

Layer 2: Systems of Insight & Coordination

Purpose: Unify fragmented customer data; derive intelligence through analytics and modeling; expose unified customer view and predictive scores to downstream systems

Primary tools:

- CDPs and RT‑CDPs (Salesforce Data Cloud, Adobe RT‑CDP, FirstHive): Ingest data from multiple sources, perform identity resolution, maintain unified profiles with real-time updates

- Data warehouses and lakes (Snowflake, BigQuery, Redshift): Centralized data repository enabling historical analysis and complex modeling

- Analytics platforms (Google Analytics, Adobe Analytics, Mixpanel): Capture user behavior across digital properties

- Modeling frameworks (scikit-learn, TensorFlow, Prophet): Build propensity, churn, lifetime value, next-best-product models

- Experimentation platforms (Optimizely, LaunchDarkly, custom solutions): Design, execute, and analyze controlled tests

- Business intelligence and reporting (Tableau, Looker, Power BI): Expose insights to business stakeholders

Critical architectural principle: These systems must have:

- Unified identity resolution across all sources—when a customer appears in 10 different systems with 10 different IDs, systems of insight must stitch them together into a single profile

- Real-time or near-real-time profile updates so that downstream decisioning systems have current information. Adobe RT‑CDP achieves 15-minute profile updates; Salesforce Data Cloud provides near real-time.

- Reusable models and features exposed as services, not isolated notebooks. A churn model should be available to marketing (for churn risk segmentation), sales (for account health scoring), service (for proactive outreach), and agents (for autonomous decisioning).

- Observability and monitoring so data quality issues are detected early and downstream systems are alerted

Example data flow:

Raw customer events flow into CDP → identity resolution stitches 10 disparate IDs into single profile → propensity model scores updated every hour → churn risk recalculated daily → models exposed via API → downstream systems query profiles and scores for decisioning

Layer 3: System of Autonomy (Agent Layer)

Purpose: Make autonomous decisions within explicit guardrails; continuously learn from outcomes; act on customer profiles and model scores; manage orchestration and optimization

Primary tools:

- Native agent platforms (Salesforce Agentforce, Adobe Copilot): Embedded intelligence that can execute workflows, make decisions, and act within Salesforce or Adobe respectively

- Cross-stack agent frameworks (LLM-based agents, agentic AI platforms, custom orchestration): Agents that span multiple systems, making decisions and orchestrating across CRM, CDP, marketing, commerce, and service platforms

- Observability and governance (audit logging, policy enforcement, role-based access): Frameworks ensuring agents operate safely and decisively within guardrails

Critical architectural principle: Agent architecture requires:

Explicit guardrails, ethics and scope

Agents must have clear boundaries: what data they can read (broadly), what actions they can take (narrowly), which human approvals are required (high-impact decisions)

Real-time logging and auditability

Every agent decision must be logged with full context: what decision, why, what was the outcome, how does this compare to baseline or human performance

Rapid rollback capability

If an agent starts misbehaving (making expensive decisions, violating policies, harming customer experience), you must be able to disable it within minutes

Human-in-the-loop where required.

Some decisions (pricing >15% below cost, messaging high-risk customers, legal/compliance decisions) require human approval

Learning and adaptation

Agents should improve over time, but only on approved dimensions. An agent should not learn to bypass guardrails in pursuit of a KPI.

Example data flow:

Agent queries CDP for customer profiles and model scores → agent evaluates multiple decision options (which offer, which channel, which timing) within guardrail constraints → agent selects option estimated to maximize KPI (conversion, retention, margin) while respecting constraints → decision is logged with rationale → message is sent → outcome (open, click, conversion) is captured → feedback loop updates models for next decision

This entire flow can happen in milliseconds for real-time decisioning, or batch overnight for next-day messaging.

Mapping Platforms To Architectural Layers

Now that the three-layer model is clear, let’s map the specific platforms from your earlier analysis to these layers and show how they interact in agent-ready architecture.

Layer 1: Systems of Record & Engagement

Salesforce

- Layer 1 role: System of record for accounts, opportunities, cases, leads. Marketing Cloud provides email and SMS execution. Service Cloud routes and resolves cases. Commerce Cloud manages transactions.

- Layer 1 capabilities: Customer 360 provides unified view across all clouds. Event emission for all customer interactions. API-rich for upstream integration.

- Agentic readiness: Einstein Copilot embedded across all clouds. Agentforce agents can execute workflows, make decisions, and act. Comprehensive audit logging and role-based access control.

- India alignment: Enterprise governance and compliance controls. Strong local partner ecosystem. DPDP-ready with appropriate configurations.

Adobe Experience Cloud

- Layer 1 role: Real-Time CDP at foundation. Journey Optimizer designs and executes journeys. Marketo handles B2B nurturing. Commerce Cloud manages transactions.

- Layer 1 capabilities: Journey Optimizer supports omnichannel (email, SMS, push, web, in-app, social). Marketo provides sophisticated B2B lead nurturing. Comprehensive APIs for integration.

- Agentic readiness: Adobe Sensei AI provides intelligence. Journey Optimizer supports AI optimization of send times, paths, content. Custom agents can read profiles via RT‑CDP API, make decisions, and trigger journeys.

- India alignment: Global platform requiring localization. Strong partnership ecosystem in India for implementation and support.

Zoho CRM

- Layer 1 role: System of record for SMB/mid-market. Email, SMS, and basic journey capabilities built in. Strong India localization.

- Layer 1 capabilities: Integrated email, SMS, and marketing automation. Native GST and Indian language support. Affordable and quick to deploy.

- Agentic readiness: Zia AI assistant embedded for scoring, forecasting, communication suggestions. Limited agent orchestration compared to Salesforce/Adobe, but sufficient for mid-market use cases.

- India alignment: Purpose-built for Indian market. Local support, regional language support, payment gateway integration.

MoEngage

- Layer 1 role: Omnichannel engagement platform. Orchestrates journeys across email, SMS, WhatsApp, push, in-app, web. Particularly strong for mobile-first engagement.

- Layer 1 capabilities: Processes 3.2 billion messages daily across 1.2 billion users. Real-time channel optimization (WhatsApp vs. SMS vs. email at individual level). Consent management and regulatory compliance.

- Agentic readiness: AI-driven channel selection, send-time optimization, journey path optimization through continuous A/B testing. Designed to work with external agents.

- India alignment: India-first platform. Deep WhatsApp integration (processing billions of META-routed messages). SMS delivery optimization for Indian carriers. Vernacular support.

CleverTap

- Layer 1 role: Behavioral analytics and engagement platform for high-frequency mobile. Excels at app-first personalization.

- Layer 1 capabilities: Granular event tracking, temporal cohort analysis (identifying users active at specific times), RFM modeling, location-based personalization (geofencing).

- Agentic readiness: AI scoring and segmentation. Can integrate with agents for journey orchestration.

- India alignment: Strong India presence. Optimized for mobile-first D2C and fintech use cases.

LeadSquared

- Layer 1 role: Sales CRM for high-volume lead management. Specialized for distributed sales teams.

- Layer 1 capabilities: Multi-dimensional lead scoring, automatic lead distribution, missed call capture and qualification, CRM workflow automation.

- Agentic readiness: Structured lead management workflows. Can integrate with agents for lead prioritization and routing optimization.

- India alignment: India-centric platform. Strong in BFSI and education verticals. Designed for Indian contact center and distributed team realities.

Netcore

- Layer 1 role: Messaging infrastructure for high-volume, regulated communications. Backbone for transactional and marketing messages.

- Layer 1 capabilities: 99.9%+ delivery reliability, SMS and WhatsApp gateway with 9% better delivery rates than competitors, NACH notifications, OTP delivery with guaranteed compliance.

- Agentic readiness: Model Context Protocol (MCP) Server support enabling AI agents to orchestrate messaging through simplified intent language.

- India alignment: India-optimized infrastructure. Deep integration with Indian telcos and ISPs. Regulatory compliance automation for BFSI and fintech.

Layer 2: Systems of Insight & Coordination

Salesforce Data Cloud

- Layer 2 role: Unified CDP based on Salesforce platform. Ingests CRM, marketing, commerce, and third-party data. Provides unified profiles and real-time activation.

- Layer 2 capabilities: Identity resolution across 1B+ profiles. Real-time profile updates. Federated audiences. AI-powered propensity and churn scoring. Activation APIs for downstream systems.

- Agentic readiness: Profiles and scores available via APIs for agent consumption. Streaming data API for real-time updates.

- India alignment: Enterprise-grade security and compliance. Configurable for DPDP and sectoral regulations.

Adobe Real-Time CDP

- Layer 2 role: Unified CDP on Adobe platform. Ingests data from Adobe tools, CRM, data warehouses, third-party providers. Maintains real-time unified profiles.

- Layer 2 capabilities: Multi-source data ingestion. Identity resolution (known + anonymous). 15-minute event availability for segmentation, 60-minute profile updates. Federated audiences without data movement. Propensity scoring via Adobe Sensei.

- Agentic readiness: Profile API for agent consumption. Event streaming for real-time awareness. Audience API for activation.

- India alignment: Global platform requiring localization investment. Strong partner ecosystem.

Snowflake/ BigQuery

- Layer 2 role: Cloud data warehouse serving as single source of truth for historical and complex analytics. Feeds modeling and experimentation platforms.

- Layer 2 capabilities: Massive scalability. Support for semi-structured data (JSON events, logs). Time-series analysis. Historical data retention.

- Agentic readiness: Data available for model training and inference. API exposure for real-time queries (with appropriate latency).

- India alignment: Global platforms with India data centers available.

FirstHive (or equivalent India CDP)

- Layer 2 role: India-native CDP. Unified profiles combining BFSI, retail, D2C, and other verticals. Data residency in India.

- Layer 2 capabilities: Identity resolution across Indian data sources. DPDP compliance by design. Indian language support. Payment ecosystem integration.

- Agentic readiness: Profile and scoring APIs for agent consumption.

- India alignment: Purpose-built for Indian market.

Layer 3: System of Autonomy

Salesforce Agentforce

- Agent capabilities: Agents that autonomously handle sales (lead qualification, opportunity management, quote generation), service (case routing, resolution, follow-up), and marketing (campaign execution, optimization, personalization) workflows.

- Real-world performance: Salesforce handles 32,000 conversations weekly with 83% autonomous resolution. Manufacturers achieved 60% reduction in quote creation time.

- Governance: Role-based access control, audit logging, policy enforcement, sandbox testing, human-in-the-loop for high-risk decisions.

Adobe Copilot & Journey Optimizer AI

- Agent capabilities: Agents that optimize journey paths in real-time, select send times and channels, optimize email and creative content, manage multivariate testing autonomously.

- Real-world performance: Media companies deliver real-time recommendations. Insurance companies trigger personalized interventions for abandoned applications. E-commerce companies achieve 25-32% conversion lifts.

- Governance: Policy-driven decision-making, audit trails, integration with role-based access control.

Custom Agent Frameworks

- Agent capabilities: LLM-based agents built on OpenAI, Claude, or open-source models. Orchestrate across multiple martech platforms. Make complex decisions by evaluating multiple options against business objectives and guardrails.

- Real-world performance: Early movers in custom agent development report 25-30% efficiency gains in marketing operations.

- Governance: Responsibility of the organization to implement—requires robust logging, policy enforcement, testing frameworks.

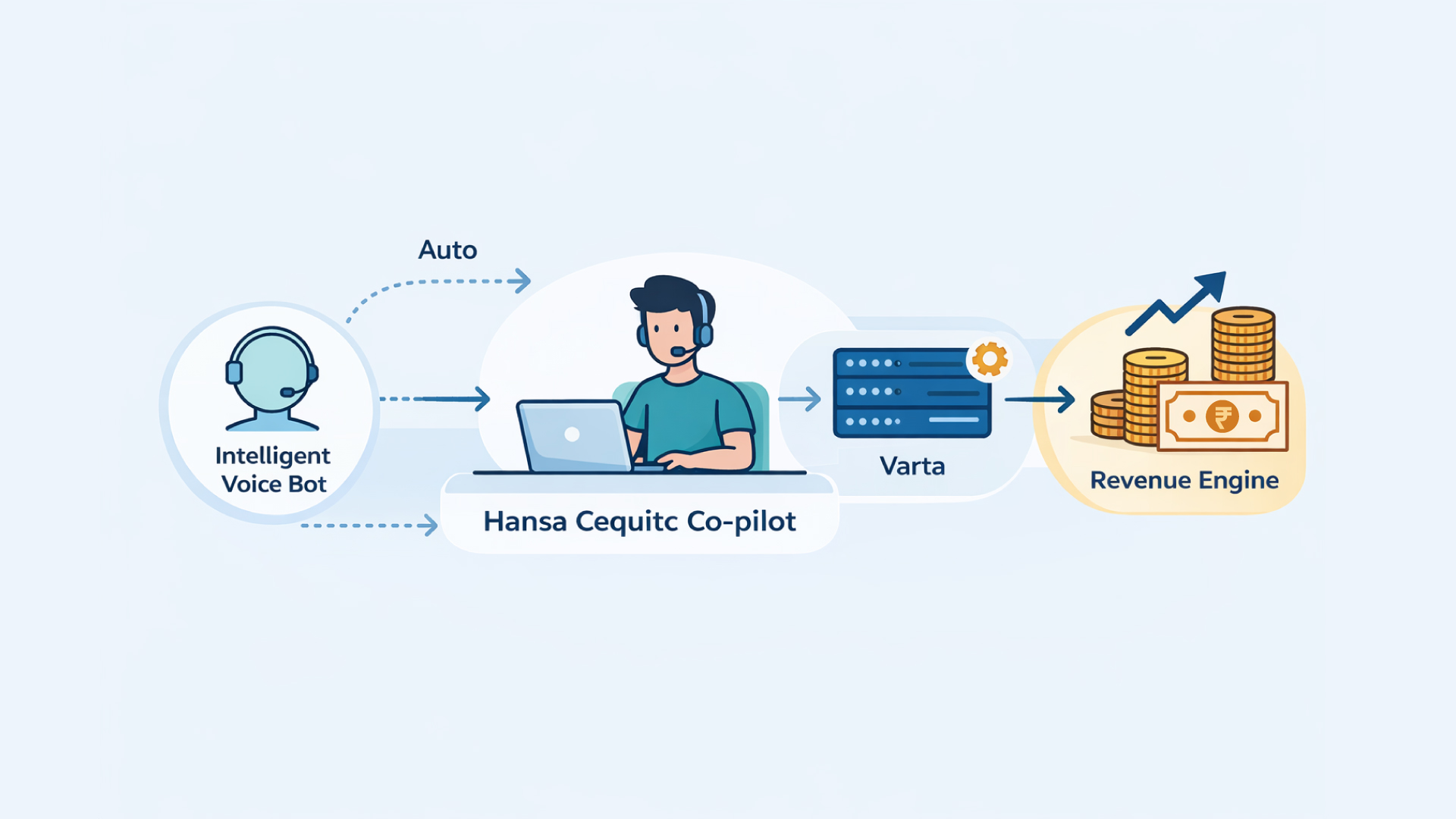

Architecture Pattern 1: The “WhatsApp Spine” Pattern For BFSI & Fintech

For Indian BFSI and fintech organizations, a particularly effective architecture has emerged. We call it the “WhatsApp Spine” pattern because WhatsApp and SMS have become the primary communication channels for customer engagement.

Layer 1 (Systems of Record & Engagement):

- Salesforce or equivalent CRM: System of record for accounts, relationships, compliance history

- LeadSquared (if applicable): Sales process management for distributed teams, missed call capture

- MoEngage or CleverTap: Omnichannel journey orchestration with WhatsApp and SMS as primary channels

- Netcore: Reliable messaging infrastructure for OTPs, policy documents, regulatory notices

Layer 2 (Systems of Insight & Coordination):

- Salesforce Data Cloud or equivalent CDP: Unified profiles stitching CRM, marketing, transaction, and behavioral data

- Analytics platform: Tracking app, web, and WhatsApp engagement

Layer 3 (System of Autonomy):

- Agents orchestrating: Risk assessment (determining which customers to target with which offers), channel selection (WhatsApp vs. SMS vs. email vs. in-app), timing optimization (when to send repayment nudges, upsell offers, service reminders)

Real example:

A large Indian NBFC implemented this pattern:

When a customer is identified as at-risk of defaulting on their loan, the agent:

- Queries the CDP for customer profile: past payment history, communication preferences, sensitivity to discounts

- Evaluates options: offer payment plan, waive late fees, refer to specialist, escalate to human support

- Selects action respecting guardrails: if customer has made 5+ payments on time, offer discount; if customer is defaulting for first time, refer to specialist; never escalate without human review

- Determines channel: customer prefers WhatsApp → target via WhatsApp; communication compliance logged

- Selects time: customer is most active 6-8 PM → schedule for 7 PM

- Sends personalized offer via WhatsApp

- Logs decision and outcome: conversion to payment plan, default prevented, customer satisfaction improved

This workflow—which would require manual work from 3-4 people if done manually—completes in seconds, applies consistent logic to all customers, and learns from outcomes.

Architectural advantages of this pattern:

- Leverages India strengths: WhatsApp and SMS delivery reliable in India; agents don’t have to fight against delivery constraints

- Respects regulatory requirements: All communications logged, consent tracked, audit trails complete

- High-frequency decisioning: Can operate in real-time for transaction-critical decisions (approve/deny, send/hold)

- Accountable: Every agent decision is traceable; compliance team can audit decisions post-facto

Architecture Pattern 2: The “CDP-First Retailer” Pattern For D2C & Retail

For Indian D2C and retail organizations, a different architectural pattern works better. In these businesses, unified customer view across online and offline channels is critical—but real-time decisioning is less critical than rich segmentation and sophisticated journey orchestration.

Layer 1 (Systems of Record & Engagement):

- Zoho or Salesforce: System of record for customer accounts, transactions, returns

- MoEngage or CleverTap: Omnichannel engagement orchestration

- E-commerce platform (Shopify, custom): System of record for orders, inventory, fulfillment

Layer 2 (Systems of Insight & Coordination):

- CDP (Salesforce Data Cloud, Adobe RT‑CDP, or FirstHive): Unified profiles stitching POS (point-of-sale), e-commerce, mobile app, and email

- Analytics: Tracking behavior across web, app, physical stores

- Modeling: Propensity to purchase, next-best-product, churn risk

Layer 3 (System of Autonomy):

- Agents orchestrating: Segment-specific journeys (high-value customers, new customers, at-risk), offer optimization (which products to recommend, discount levels), channel selection (email vs. SMS vs. WhatsApp), timing

Real example:

A Tier-1 D2C beauty brand implemented this pattern:

They discovered that their customer base divides into three archetypes:

- High-intent explorers: View products 3+ times, research extensively, respond quickly to offers

- Low-intent browsers: View products 1-2 times, are price-sensitive, churn if over-messaged

- Loyal repeaters: Purchase every 4-6 weeks, engage with educational content, tolerate higher prices

They configured agents to:

- High-intent explorers: Segment triggers WhatsApp offer within 2 hours, 15-20% discount, educational content on product benefits

- Low-intent browsers: Segment receives weekly email summary of new products, occasional SMS on seasonal sales, no pressure

- Loyal repeaters: Segment receives personalized product recommendations, 5-10% loyalty discount, exclusive early access to new products

Agents dynamically adjust based on changing behavior: if a low-intent customer suddenly views 5 products, they transition to high-intent treatment; if a high-intent customer hasn’t engaged in 14 days, they receive a winback campaign.

Results:

- High-intent conversion rate improved 25-30%

- Low-intent churn reduced 18%

- Loyal repeater lifetime value increased through increased purchase frequency

- Manual journey management eliminated; agents handle cohort adjustments continuously

Architectural advantages of this pattern:

- Rich segmentation: Agents can manage 10+ customer archetypes simultaneously

- Flexible orchestration: Journeys adapt based on customer behavior change

- Omnichannel: Agents coordinate across email, SMS, WhatsApp, in-app messaging

- Scalable: Same agent logic applies to millions of customers; no team scaling required

Critical Architectural Decisions

Within the three-layer framework and the two patterns outlined, several architectural decisions require explicit deliberation:

Decision 1: Where is the “golden” source of truth?

One system should be designated as the authoritative customer profile. All other systems reference it. This prevents conflicting customer data from creating agent confusion.

Options:

- CDP is golden: Salesforce Data Cloud, Adobe RT‑CDP, or FirstHive maintains customer truth. CRM, marketing platforms, service platforms all query CDP. CDP updates triggered by events from systems of record.

- CRM is golden: Salesforce or Zoho maintains customer truth. CDP is enrichment layer. Marketing and service systems query CRM through APIs.

- Warehouse is golden: Data warehouse (Snowflake, BigQuery) maintains customer truth. CDP, CRM, and marketing platforms are views fed from warehouse.

For agentic architectures, the CDP-as-golden approach is typically superior because:

- CDPs are designed for identity resolution (critical for omnichannel agents)

- Real-time updates mean agents have current data

- Propensity and scoring models live in the CDP layer, immediately available to downstream agents

- Privacy-by-design (federated audiences without data movement) aligns with DPDP requirements

Decision 2: Where do agents live?

Three options:

Option 1: Native agents within platforms

- Salesforce Agentforce agents operate within Sales, Service, Marketing clouds

- Adobe Copilot agents operate within Journey Optimizer

- Agents make decisions and take action natively

- Advantage: Native governance, audit trails, tight integration. Disadvantage: Agents limited to platform’s capabilities; hard to orchestrate across platforms

Option 2: Centralized agent hub

- Dedicated agent orchestration platform (custom LLM agent, commercial platform like Langchain, Anthropic)

- Agents read from CDP, orchestrate across platforms via APIs

- Single governance layer for all agents

- Advantage: Unified governance, cross-platform orchestration. Disadvantage: Requires investment in custom integration; more complex to manage

Option 3: Hybrid

- Platform-native agents for platform-specific decisions (Salesforce Agentforce for sales processes)

- Centralized agents for cross-platform orchestration (customer journey decisions)

- Advantage: Balances native integration with cross-platform orchestration. Disadvantage: Requires governance across multiple agent layers

For Indian enterprises, Option 1 (native agents) is recommended for most cases because Salesforce and Adobe both offer comprehensive native agent capabilities with strong governance. As your needs grow beyond platform boundaries, you can add custom agents (Option 3).

Decision 3: How are guardrails implemented?

Guardrails are the explicit constraints within which agents must operate. They prevent agents from making expensive mistakes or violating policies.

Key guardrails to define:

- Data access: Agent can read customer profile, segment, propensity scores, transaction history. Agent cannot access PII outside of operational scope (credit scores, medical history, family data).

- Action permissions: Agent can send email, SMS, WhatsApp, in-app messages. Agent cannot make pricing decisions >10% discount without human approval; cannot offer discounts >20% ever.

- Frequency caps: Customer can receive maximum 3 messages per week; if at frequency cap, agent must select least-valuable message to hold back.

- Business logic: Agent must respect customer’s communication preferences (opt-out, do-not-contact). Agent must follow consent rules (only send marketing to opted-in customers).

- Escalation paths: If agent encounters situation outside its training (customer threatens legal action, payment dispute, security concern), escalate to human with full context.

Implementation approaches:

- Policy engine: Centralized system that evaluates every agent decision against policy rules before execution. Slower (adds latency) but foolproof.

- Agent training: Agents trained on guardrails; expected to self-constrain. Faster but requires robust monitoring for violations.

- Hybrid: Agents self-constrain on most decisions; policy engine reviews high-impact decisions (>X amount discount, messaging segment Y, etc.) before execution.

For agentic martech, hybrid is recommended: let agents move at speed on low-risk decisions, apply policy checks to high-impact decisions.

Decision 4: How are agents monitored?

Real-time monitoring of agent behavior is critical for catching misbehavior early and building organizational trust.

Key monitoring dimensions:

- Performance: Is the agent achieving its KPIs? If agent is supposed to optimize conversion, is conversion actually improving?

- Safety: Is the agent violating guardrails? Offering discounts outside approved range? Messaging opted-out customers? Escalating improperly?

- Fairness: Is the agent treating customer segments equitably? Or is it learning biases (e.g., offering better terms to certain demographic groups)?

- Explainability: When an agent makes a surprising decision, can you understand why? (This is the explainability requirement from DPDP and sectoral regulations.)

Monitoring should happen at multiple levels:

- Real-time dashboards: Marketing team sees agent performance, exceptions, escalations

- Automated alerts: When agent violates guardrail or performance metric degrades, alert is triggered

- Weekly reviews: Agent council reviews agent performance, decides on scope expansion or contraction

- Quarterly audits: Deep analysis of agent decision patterns, fairness assessment, bias detection

Mapping Platforms To Architecture: Reference Implementations

To make the architecture concrete, several reference implementations for common Indian enterprise scenarios:

Scenario 1: BFSI Retail Bank (500K – 5M customers)

Recommended architecture:

- Layer 1: Salesforce CRM (account management), MoEngage (journey orchestration), Netcore (reliable messaging)

- Layer 2: Salesforce Data Cloud (unified profiles), analytics for engagement tracking

- Layer 3: Salesforce Agentforce agents (managing onboarding, activation, cross-sell, churn rescue)

Implementation sequence:

- Month 1-3: Deploy Salesforce CRM and Data Cloud; load customer master data

- Month 3-6: Implement MoEngage and Netcore; establish data flows from CRM to Data Cloud

- Month 6-9: Build churn prediction and cross-sell propensity models; integrate into Data Cloud

- Month 9-12: Configure Agentforce agents for churn rescue workflow; pilot with 5% of at-risk customer base

- Month 12-18: Expand to onboarding and cross-sell workflows; scale agents to 100% of customer base

Expected outcomes:

- 15-20% reduction in churn rate for at-risk customers

- 2-3% lift in cross-sell conversion

- 50%+ reduction in manual decisioning for routine onboarding

- Zero compliance incidents with full audit trail

Scenario 2: D2C E-commerce (1M – 10M customers)

Recommended architecture:

- Layer 1: Zoho CRM or custom system (customer records), MoEngage or CleverTap (journey orchestration), custom or Shopify Plus (e-commerce)

- Layer 2: FirstHive or Adobe RT‑CDP (unified profiles stitching POS + online + app), analytics

- Layer 3: MoEngage AI agents or custom agents (managing segment-specific journeys, offer optimization)

Implementation sequence:

- Month 1-3: Establish data flows from e-commerce, app, email into CDP

- Month 3-6: Build customer segmentation (high-intent, low-intent, loyal) and baseline KPIs

- Month 6-9: Deploy propensity and churn models; integrate into CDP

- Month 9-12: Configure agents for segment-specific journey orchestration; pilot with onboarding cohort

- Month 12-18: Expand to activation and retention journeys; continuous learning loop

Expected outcomes:

- 25-30% faster conversion for high-intent customers

- 18% reduction in churn for low-intent customers

- 40%+ increase in repeat purchase rate for loyal cohort

- 70% reduction in manual journey management

Scenario 3: Fintech Platform (100K – 1M users)

Recommended architecture:

- Layer 1: LeadSquared (lead management for growth) + custom systems (KYC, transaction processing), CleverTap (engagement), Netcore (OTP/transaction notifications)

- Layer 2: FirstHive or custom CDP (profiles + transaction data), analytics

- Layer 3: Custom agents (managing acquisition funnels, onboarding journeys, product recommendations)

Implementation sequence:

- Month 1-3: Establish data flows and identity resolution; ensure compliance data tracking

- Month 3-6: Build propensity models (likelihood to open account, likelihood to fund, likelihood to transact)

- Month 6-9: Deploy agents for onboarding optimization; manage messaging cadence and channel selection

- Month 9-12: Expand to product recommendation agents (which feature to promote, which product to upsell)

- Month 12-18: Autonomous journey orchestration across acquisition, activation, retention

Expected outcomes:

- 20% improvement in funnel conversion (acquisition → account → first transaction)

- 30% reduction in support tickets through better onboarding

- 40% higher feature adoption through intelligent in-app messaging

- 2-3% improvement in retention through personalized product recommendations

Conclusion: Architecture As Competitive Advantage

The organizations that will win in 2026 are not those with the “best” individual tools. They are organizations that have thought deeply about how data flows, where decisions happen, how humans and agents interact, and what governance ensures safety and compliance.

Your martech architecture in 2026 should be:

- Agent-ready: Designed explicitly to support autonomous decision-making within guardrails

- Data-rich: Real-time, unified profiles available to agents with propensity and risk scores

- Governed: Clear audit trails, role-based access, policy enforcement, human-in-the-loop for high-risk decisions

- India-aligned: Data residency in India, integration with WhatsApp and SMS, support for vernacular languages, compliance with DPDP and sectoral regulations

The architecture you choose now will determine your agility in 2026 and beyond. Choose carefully, with eyes wide open to both opportunity and risk.

Part 3: ROI & Governance

Agentic Martech For Indian Enterprises – Part 3: ROI & Governance

Beyond Dashboards: Closing The Martech ROI Gap In The Age Of AI Agents

The Core Challenge: Why Most Martech Investments Underdeliver

A pattern has emerged consistently across enterprise martech implementations, replicated across geographies and verticals: organizations invest significant capital in martech platforms, executives approve budgets based on compelling vendor pitches and case studies, implementations launch on schedule, and then—12-18 months later—executives ask uncomfortable questions.

“What exactly did we get for that ₹2 crore investment?”

“Our CMO said this platform would increase customer lifetime value by 30%. Our data shows 3%. What happened?”

“We deployed this CDP 18 months ago. How do I measure whether it was worth it?”

The research is consistent: 61% of CMOs report difficulty proving martech ROI despite 90% of C-suite believing best-in-class tools drive strategic value. That gap—between executive belief and documented business impact—is not because the tools are bad. It is because organizations failed to define ROI upfront, establish measurement discipline, and govern implementation for outcomes rather than features.

The introduction of AI agents amplifies this problem.

Why agents raise ROI stakes:

- Scale of decisions increases 1000x. Traditional platforms make decisions about 100 customers per day (send this email, don’t send that email). Agents make decisions about millions of customers across thousands of decision points per day. The cumulative impact—for better or worse—is enormous.

- Autonomy creates accountability gaps. When a CMO manually decides to send an email campaign, she is accountable for the outcome. When an agent decides, accountability becomes murky. Did the agent decide poorly? Did the data quality cause the agent to make bad decisions? Did the guardrails fail?

- Risk profile changes. A poorly performing email campaign costs ₹5-10 lakhs in media spend and temporary harm to engagement metrics. An agent that learns the wrong objective (volume over profitability, short-term conversion over retention) can cause ₹10 crore+ in damage before it is detected.

For Indian enterprises in BFSI, fintech, insurance, and healthcare, this risk is particularly acute. Regulators are watching. Customers are sensitive. A single AI misfire—discriminatory pricing, privacy violation, compliance breach—can trigger regulatory action, customer churn, and reputation damage.

This section is written for CFOs, audit committees, chief risk officers, and CMOs responsible for justifying AI investment and managing associated risks. It provides frameworks for:

- Defining and measuring true ROI across multiple dimensions

- Establishing AI/Agent governance that manages risk while enabling innovation

- Building organizational confidence in AI through transparency and continuous improvement

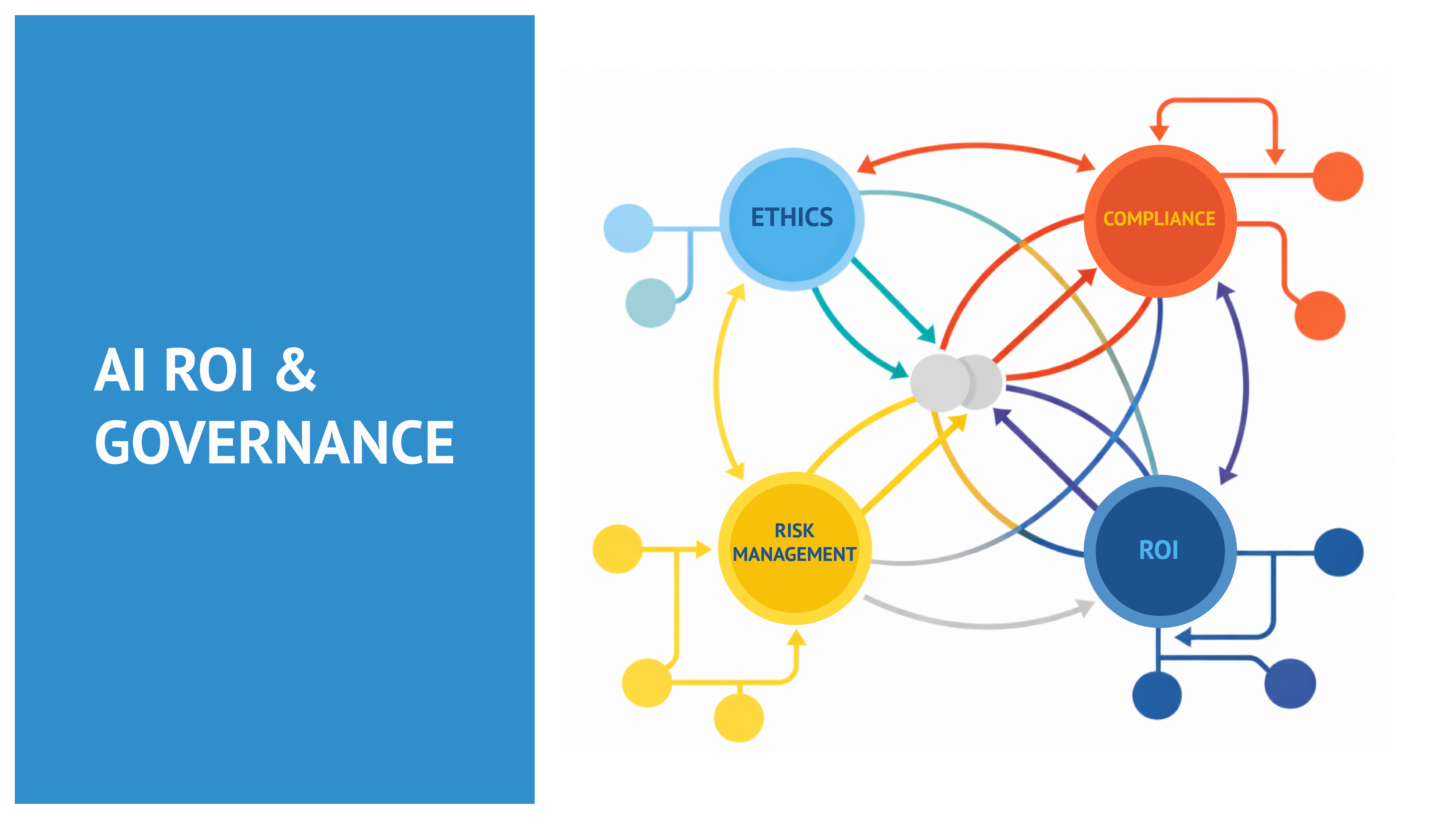

The Three-Dimensional ROI Scorecard

Rather than treating martech as a single investment with a single ROI figure, organizations should evaluate across three interdependent dimensions. Together, they tell the full story of value creation and risk management.

Dimension 1: Revenue Impact

Definition: Incremental revenue generated through personalization, faster customer decisions, improved customer experience, and optimized journeys.

How to measure:

Organizations should establish baseline metrics before agents are introduced. For a given customer journey (e.g., onboarding, cross-sell, churn rescue), document current performance:

- Conversion rate (percentage of customers who complete desired action)

- Time-to-conversion (days from entry to completion)

- Customer lifetime value for converted cohort

- Revenue per customer per month

Then, introduce agents to a subset (60% treatment, 40% control) and track the same metrics for 60-90 days.

Calculate incremental lift:

- Treatment cohort conversion: 12%

- Control cohort conversion: 10%

- Incremental lift: 20% (2 percentage points on 10% baseline)

- If treating 100,000 customers/month: 2,000 incremental conversions

- If average revenue per conversion: ₹50,000

- Revenue impact: ₹10 crore/month (₹120 crore annually)

Real-world benchmarks from global implementations:

- E-commerce: 25-32% conversion rate increase; 30% CAC reduction

- SaaS: 18% churn reduction through personalized onboarding

- Retail: 32% lift in product page conversion through AI optimization

- B2B: 25% increase in conversion rates

- Average ROI: 300% within first 6 months; 25% annual revenue increase

For Indian enterprises:

A large fintech platform implemented personalized onboarding journeys using agents. They found:

- Baseline: 8% of users fund their account within 30 days

- Agent-managed cohort: 9.5% fund within 30 days

- Incremental lift: 18.75%

- At scale: 500,000 new users/month × 18.75% × ₹500 average first transaction = ₹46.8 crore incremental revenue annually

Critical success factors:

- Proper control groups: Never measure a treatment against a moving baseline. Always maintain holdouts.

- Sufficient sample size: 60-90 days minimum to capture seasonal variation

- Multiple metrics: Track conversion, revenue, customer satisfaction, not just vanity metrics (opens, clicks)

- Attribution discipline: Don’t claim credit for revenue that happened for other reasons (seasonal bump, paid media increase, product launch)

Dimension 2: Operational Autonomy & Productivity Gains

Definition: Reduction in team effort required to achieve marketing outcomes; redeployment of talent from routine execution to strategic work; scalability without proportional headcount growth.

How to measure:

Organizations should conduct time-motion studies of critical marketing functions before and after agent implementation:

Example: Email campaign execution

Before agents (status quo):

- CMO identifies opportunity for new segment

- Marketer designs email, determines send time, selects audience

- Email is reviewed for compliance, approved

- Campaign is scheduled for 9 AM Tuesday

- Campaign executes

- Next day, results reviewed

- Underperforming variants are manually paused

- High-performing variants are identified for future use

- Total time: 8-10 hours of team time per campaign

After agents:

- CMO identifies opportunity for new segment

- Agent automatically designs 5-10 email variants, tests with small sample

- Agent selects best performer, scales to full segment

- Campaign executes with dynamic send times optimized per customer

- Agent continuously monitors performance, pauses losers, allocates traffic to winners

- Results are automatically analyzed and learnings captured

- Total time: 1-2 hours of team time (monitoring, governance)

- Productivity gain: 75-80%

Multiply this across all campaigns run annually: 50 campaigns × 8 hours saved = 400 hours saved = 10 weeks of team capacity freed.

Converting to financial impact:

- 10 weeks × 1 marketer = ₹25-30 lakh annual savings (cost of marketer salary/benefits) OR

- The Same team now runs 100 campaigns/year instead of 50 (without hiring)

Real-world benchmarks from enterprise implementations:

- Sales operations: 60% reduction in quote creation time; 40% faster approvals

- SDR teams: 50% faster lead response; 40% increase in email response rates; 2 hours/day freed per rep

- Customer service: 83% autonomous resolution rate; 60% reduction in wait times

- Claims processing: 60% faster processing; 40% backlog reduction

- Integration reliability: 95% improvement

For Indian enterprises:

A BFSI organization implemented lead scoring and routing agents for their mortgage business:

Before:

- 5 people on lead team

- Manual scoring: 100+ leads/day taking 30 minutes per lead = 50 hours/day

- Route-to-sales took 3-4 hours after scoring

- Total: 60-70 hours/day, 300+ hours/week

After:

- 2 people on lead team (one monitoring, one handling exceptions)

- Agent scoring: 100+ leads/day processed in 2 minutes total = 0.2 hours/day

- Route-to-sales: Agent-driven, instant

- Total: 4-5 hours/day, 20+ hours/week

Productivity gain: 280+ hours/week freed = 1.5 FTEs worth of capacity

Financial impact: 1.5 × ₹30 lakh = ₹45 lakh annual savings

But the real impact was redeployment: instead of cutting 3 people, the company reassigned them to:

- Strategy work (designing next-gen customer experiences)

- Relationship management (handling complex cases, customer escalations)

- Continuous improvement (analyzing agent performance, refining guardrails)

These roles generated more value than pure lead routing.

Critical success factors:

- Baseline measurement: Document team effort before agents. This becomes benchmark.

- Task-level analysis: Understand where time is actually spent. Focus on routine, repetitive tasks with clear outcomes.

- Redeployment planning: Freed capacity should be redeployed to high-value work, not just reduce headcount (retention, loyalty, long-term value)

Dimension 3: Risk, Compliance & Brand Protection

Definition: Incidents prevented through AI governance; regulatory violations averted; brand damage mitigated; customer trust maintained.

Why this matters:

Risk mitigation is the most undervalued dimension of AI ROI. A single preventable AI incident—a discriminatory decision, a privacy breach, a compliance violation—can cost millions in regulatory fines, customer churn, and reputation damage.

Yet organizations rarely quantify the value of prevention. They track revenue and productivity but not risks mitigated.

How to measure:

- Guardrail effectiveness: Track instances where guardrails prevented prohibited actions.

Example:

- Agent designed a pricing offer: 30% discount for customers identified as “price-sensitive”

- Policy rule flagged: discount >25% requires supervisor approval

- Alert triggered, supervisor reviewed, found that “price-sensitive” cohort was predominantly lower-income customers (potential fairness issue)

- Discount rejected, agent rule adjusted

- Value prevented: Potential regulatory action, customer harm, reputational damage. Estimated value: ₹5-10 crore

Track metrics:

- Number of guardrail violations prevented per month

- Severity of prevented violations (cost if they had occurred)

- Time to detection and remediation

- Compliance incidents: Track compliance breaches attributable to AI decisions.

Expected: In well-governed implementations, zero major incidents. If breaches occur, rapid detection and remediation.

For example:

- Insurance company’s AI agent identified customers likely to lapse and sent targeted retention offers

- Risk team audited agent decision logs and found the agent was disproportionately targeting female customers over 60 (potential age/gender discrimination)

- Because logs were complete, the team identified exactly which 2,000 customers were affected

- They corrected the offer, issued apologies, and prevented escalation to regulators

- Value: Prevented ₹10-50 crore in potential regulatory fines, customer lawsuits, and brand damage

- Incident velocity: Track how quickly issues are identified and remediated.

- Without logging: Issue might go undetected for months. Cost: ₹crores by the time it is discovered.

- With governance: Issue detected within hours/days. Cost: ₹lakhs to fix.

- Difference: ₹crores in avoided harm

- Customer trust and retention: Track whether AI governance improves customer confidence.

Measure:

- Trust metrics (would you recommend us to a friend?)

- Net Promoter Score (NPS)

- Churn rate

- Complaint volume

Organizations with visible AI governance and transparency often see improvements in these metrics compared to peers with opaque AI.

Real-world examples:

Insurance company incident:

An insurer’s AI agent was making renewal decisions and pricing adjustments. An audit revealed that the agent had learned to downgrade policy ratings for certain customer segments in ways that appeared discriminatory.

Because the system had complete audit trails:

- They identified exactly which 5,000 policies were affected

- They corrected pricing and issued refunds/credits

- They updated agent guardrails to prevent future bias

- Total remediation cost: ₹1-2 crore

- Cost if undetected: ₹50+ crore in regulatory fines + reputational damage

Benchmark from global implementations:

Organizations with strong AI governance report:

- Zero major incidents (compared to industry baseline of ~10% having incidents)

- 75% faster issue detection and remediation

- 20%+ improvement in customer trust metrics

- Lower regulatory scrutiny and better regulator relationships

For Indian enterprises:

In BFSI and regulated industries, risk mitigation is not a cost center—it is a competitive advantage. Organizations that can credibly say “our AI is governed and auditable” will attract customers from competitors who cannot.

Building The AI/ Agent Council: Governance In Practice

Strategy and ROI frameworks are important, but they remain abstract without a governance structure to execute them.

Leading organizations are establishing AI/Agent Councils as the central governance body for agentic martech. This council is distinct from traditional steering committees. It has real authority, meets regularly, owns decisions, and is accountable for outcomes.

Composition:

- Chair: CMO, CDO, or Chief Digital Officer (executive sponsor with authority to make decisions)

- Core members: (8-12 people)

- VP Marketing or Senior Marketer (business owner)

- VP Data/Analytics (data quality, model performance)

- Chief Risk Officer or Compliance Officer (regulatory, fairness)

- General Counsel or Legal (privacy, data protection)

- Chief Technology Officer or VP Engineering (infrastructure, scalability)

- Finance (budget, ROI tracking)

- HR/Organizational Development (change management, capability building)

- Customer Experience or Customer Success (customer impact, trust)

- Extended members: (occasional attendance)

- Platform vendors (technical updates, roadmap)

- Implementation partners (progress, challenges)

- Data scientists (model performance, bias analysis)

- External advisors (regulatory updates, best practice)

Cadence:

- Bi-weekly tactical reviews (1 hour): Agent performance metrics, exceptions, guardrail violations, risk alerts

- Monthly strategic reviews (2 hours): Platform health, ROI progress, scope expansion decisions, customer feedback

- Quarterly deep dives (4 hours): Fairness audits, competitive analysis, organizational readiness assessment

- Annual planning (full day): Budget allocation, roadmap approval, strategic pivots

Responsibilities: